As We Said – U.S. a Net Exporter of Total Energy

Dean Foreman

Posted December 12, 2019

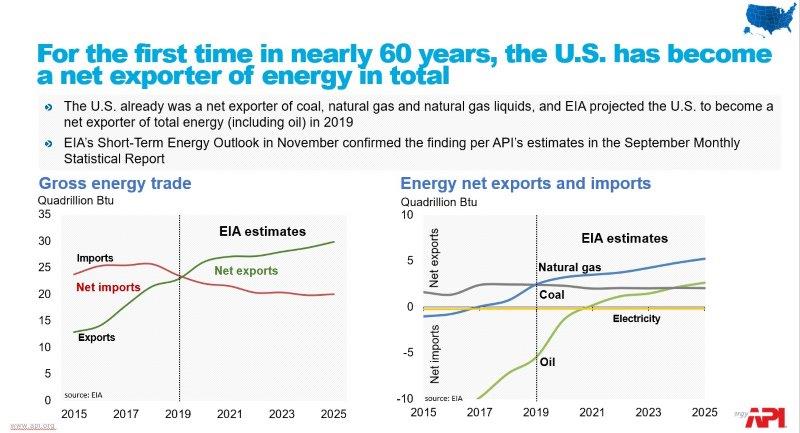

In case you missed it, the U.S. Energy Information Administration (EIA) recently confirmed (see here and here) what API indicated in its Monthly Statistical Report (MSR) for September: For the first time since the 1950s, the United States is now a net exporter of energy in total.

Achieving this milestone is important for America. It embodies a slew of economic benefits, including lower energy prices – also those due to supply growth – rejuvenated investment in resource development, processing and transportation. It also has helped U.S. refining, petrochemicals and manufacturing, which have weathered the storm of U.S. trade restrictions and a strong U.S. dollar that made exporting U.S. goods more challenging.

Some call this milestone U.S. energy independence. The Trump Administration refers to it as energy dominance. Another way to phrase it is “energy interdependence,” since achieving the milestone has been marked by export-led growth of oil and natural gas.

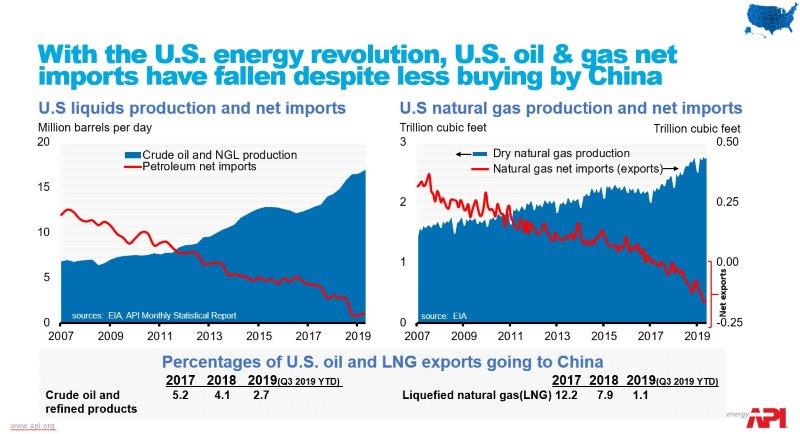

Remarkably, the U.S. petroleum trade position was positively transformed despite less buying of our petroleum exports by China. The shares of U.S. natural gas, oil and refined products going to China declined to negligible amounts in 2019 as a result of the trade war.

This buoyancy of U.S. energy trade has been driven by the fact that global oil and refined products, and to a lesser extent natural gas, can be fungible commodities. That is, if China elects to buy oil from Iran, U.S. oil can be traded to other markets. At least this has been the case for the past couple of years. However, since China is the world’s top growth market for oil and natural gas imports, there could be limits to how much U.S. energy exports could expand without China willing to buy. But so far, so good.

Keeping our eye on the big picture, three things stand out among recent trends as the U.S. experienced:

1) Record monthly records crude oil and natural gas production;

2) Record domestic petroleum demand for October; and,

3) Lower prices

This hat trick has been made possible only because the supply growth that led to energy interdependence has endured based on U.S. technology leadership in energy development.

And to bring this home for the typical U.S. household, the bottom line matters: these three trends have meant Americans have more dollars available to spend on other things – to the tune of more than $200 billion nationwide when we compare U.S. household energy spending in recent years compared with 2010, before the energy revolution accelerated, adjusted for price inflation (EIA).

Important questions going forward concern how to sustain the momentum for U.S. consumers and the economy as global headwinds persist, particularly with potential China tariff escalation, which many hope will be postponed.

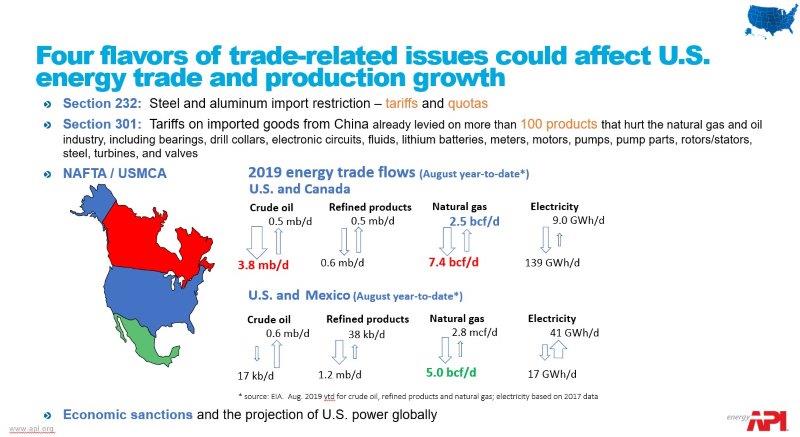

Beyond China, trade restrictions under Section 232 that affect steel and aluminum imports and importantly the ratification of USMCA as a replacement for NAFTA are equally vital to the U.S. energy revolution, with respective large capital investments requiring specialized steel products and supply chains being integrated across North America.

A fourth flavor of trade-related issues is the projection of U.S. economic power via sanctions, which has helped enable OPEC nations to balance the market for example by restricting Iranian oil supplies.

If it seems like there are a lot of moving parts, that’s because the recent global economic backdrop has remained touch-and-go. Energy abundance is the security blanket that U.S. consumers have quietly counted on. As 2020 approaches, let’s keep the energy interdependence milestone in mind but not take it for granted. Our country must pursue policies that enable the infrastructure and trade needed to underpin continued U.S. energy prosperity.

About The Author

Dr. R. Dean Foreman is API’s chief economist and an expert in the economics and markets for oil, natural gas and power with more than two decades of industry experience including ExxonMobil, Talisman Energy, Sasol, and Saudi Aramco in forecasting & market analysis, corporate strategic planning, and finance/risk management. He is known for knowledge of energy markets, applying advanced analytics to assess risk in these markets, and clearly and effectively communicating with management, policy makers and the media.