Issues

Learn how we engage with policy makers to ensure safe, reliable, and affordable energy for the future as demand continues to grow.

Energy Insights

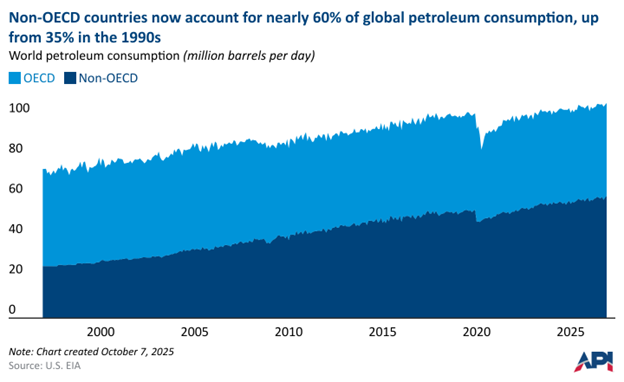

API's Energy Insights Hub provides updated statistics, data visualizations, timely analysis, and in-depth reports on all aspects of the oil and natural gas industry.

Global Industry Services

API’s Global Industry Services drives safety and efficiency within the oil and gas industry through standards, certifications, assessments, training and more.